|

FYI

- Our cybersecurity testing meets

the independent pen-test requirements outlined in the FFIEC Information Security booklet. Independent pen-testing is part of any financial institution's cybersecurity defense.

To receive due diligence information, agreement and, cost saving fees,

please complete the information form at

https://yennik.com/forms-vista-info/external_vista_info_form.htm. All communication is kept strictly confidential.

FYI

- DDoS botnet makes slaves of your home and office routers -

Researchers have discovered a botnet which comprises of tens of

thousands of hijacked home routers. A massive DDoS botnet made up of

a slave network of hijacked home and office routers has been

revealed.

FYI

-

Russian hacking group was set to hit U.S. banks - A Russian hacking

group was poised to launch a cyber assault on U.S. banks, but may

have withdrawn those plans after being discovered.

http://thehill.com/policy/cybersecurity/241965-russian-hacking-group-was-set-to-hit-us-banks

FYI

-

Hack of airplane systems described in FBI docs raises security

questions - Claims and accusations continue to fly about security

researcher Chris Roberts's alleged tampering with airplane flight

control systems, with unsealed FBI warrants suggesting that Roberts

commandeered a plane briefly and experts questioning the veracity of

those assertions.

http://www.scmagazine.com/fbi-warrant-indicates-security-researcher-commandeered-plane-briefly/article/415361/

http://www.wired.com/2015/05/feds-say-banned-researcher-commandeered-plane/

FYI

-

Data breaches ‘increasing substantially’ - The rate of major data

breaches in the United States is rapidly increasing, as hackers

around the world become more sophisticated, a top FBI cyber official

said Thursday.

http://thehill.com/policy/cybersecurity/242110-fbi-official-data-breaches-increasing-substantially

FYI

- Employees acknowledge risky security behavior, continue to engage

in it - While most people acknowledge the security risks of opening

an email from an unknown sender or downloading an app from an

unauthorized app store, many continue to engage in this risky

behavior.

http://www.scmagazine.com/blue-coat-system-conducts-security-survey/article/415611/

FYI

- Federal prosecutors charge Chinese nationals with trade secret

theft - Over the weekend, federal agents arrested a Chinese

professor who had just entered the United States via a flight to Los

Angeles – one of six Chinese nationals charged with economic

espionage and theft of trade secrets from U.S. tech firms.

http://www.scmagazine.com/professor-other-chinese-nationals-indicted-on-32-counts/article/415887/

FYI

- How fear and self-preservation are driving a cyber arms race -

Silicon Valley is pouring more money into Internet security

companies than ever before. hen a man was fired from his job in

Minneapolis, Minn., last May, he inadvertently touched off a boom in

Silicon Valley.

http://www.cnet.com/news/how-fear-and-self-preservation-are-driving-a-cyber-arms-race/

FYI

- FTC gives thumbs up to companies that cooperate during breach

probes - The Federal Trade Commission (FTC) views a company “more

favorably” if it cooperates during the course of a data breach

investigation than one that doesn't, the commission said in a

Wednesday blog post.

http://www.scmagazine.com/ftc-gives-thumbs-up-to-companies-that-cooperate-during-breach-probes/article/416165/

ATTACKS, INTRUSIONS, DATA THEFT & LOSS

FYI

-

Starbucks app targeted by hackers to drain bank accounts - Hackers

are believed to have been stealing money from people’s bank accounts

in the US using coffee giant Starbucks’ mobile app.

http://www.siliconrepublic.com/enterprise/item/42033-starbucks-app-targeted-by/

FYI

-

SEA hacks Washington Post mobile site - On Thursday, The Washington

Post's mobile website was hacked by the Syrian Electronic Army

(SEA), the same hacker collective that targeted the Post in an

August 2013 incident impacting several news sites.

http://www.scmagazine.com/sea-hacks-washington-post-mobile-site/article/415044/

FYI

-

Penn State breached by two threat actors, earliest attack in 2012 -

Penn State University is notifying roughly 18,500 individuals and

public and private research partners that their personal information

may have been compromised by two threat actors that were identified

on the College of Engineering network, one of who appears to be

based in China.

http://www.scmagazine.com/penn-state-breached-by-two-threat-actors-earliest-attack-in-2012/article/415037/

FYI

-

Three MetroHealth computers infected with malware, patients notified

- Ohio-based MetroHealth is notifying nearly 1,000 patients that

three computers in its Cardiac Cath Lab were infected with malware,

and the affected computers contained their personal information.

http://www.scmagazine.com/three-metrohealth-computers-infected-with-malware-patients-notified/article/415322/

FYI

-

Cyber extortionists targeting hedge funds - The government is

working with "several" hedge funds that have been victims of cyber

extortionists, said John Carlin, head of the Justice Department's

National Security Division.

http://www.usatoday.com/story/money/business/2015/05/08/hedge-funds-conference-cyber-espionage/26983845/

FYI

-

CareFirst

BlueCross BlueShield breached, more than one million individuals

notified - CareFirst BlueCross BlueShield is notifying more than one

million individuals that their personal information could have been

accessed by attackers who gained limited, unauthorized access to a

single CareFirst database in June 2014.

http://www.scmagazine.com/carefirst-tells-members-attackers-may-have-accessed-their-info/article/415879/

FYI

-

Cyberattack

on Penn State exposes passwords of 18K people - The university's

president apologizes for a "sophisticated" security breach that it

says involved an attack launched from China. Pennsylvania State

University's College of Engineering revealed Friday that it has been

the target of two "highly sophisticated" cyberattacks over the last

two years.

http://www.cnet.com/news/penn-state-cyberattack-exposes-passwords-from-18k-people/

FYI

-

UC Browser

found leaking personal data - UC Browser, the most popular mobile

web browser in China and India, contains multiple security and

privacy issues in both the English and Chinese versions of its

Android app.

http://www.scmagazine.com/researchers-investigate-uc-browsers-privacy-and-security/article/416129/

FYI

-

Telstra

discloses Pacnet security breach - Shortly after completing its

acquisition last month, Australia-based Telstra learned that an

unauthorized third party gained access to the corporate IT network

of data center operator Pacnet, according to post by Mike Burgess,

CISO of Telstra.

http://www.scmagazine.com/telstra-discloses-pacnet-security-breach/article/416109/

Return to the top

of the newsletter

WEB SITE COMPLIANCE -

OCC - Threats from

Fraudulent Bank Web Sites - Risk Mitigation and Response Guidance

for Web Site Spoofing Incidents (Part 5 of 5) Next week we will

begin our series on the Guidance on Safeguarding Customers

Against E-Mail and Internet-Related Fraudulent Schemes.

PROCEDURES TO ADDRESS SPOOFING - Contact the

OCC and Law Enforcement Authorities

If a bank is the target of a spoofing incident, it should promptly

notify its OCC supervisory office and report the incident to the FBI

and appropriate state and local law enforcement authorities. Banks

can also file complaints with the Internet Fraud Complaint Center

(see http://www.ic3.gov), a

partnership of the FBI and the National White Collar Crime Center.

In order for law enforcement authorities to respond effectively to

spoofing attacks, they must be provided with information necessary

to identify and shut down the fraudulent Web site and to investigate

and apprehend the persons responsible for the attack. The data

discussed under the "Information Gathering" section should meet this

need.

In addition to reporting to the bank's supervisory office and law

enforcement authorities, there are other less formal mechanisms that

a bank can use to report these incidents and help combat fraudulent

activities. For example, banks can use "Digital Phishnet" (http://www.digitalphishnet.com/),

which is a joint initiative of industry and law enforcement designed

to support apprehension of perpetrators of phishing-related crimes,

including spoofing. Members of Digital Phishnet include ISPs,

online auction services, financial institutions, and financial

service providers. The members work closely with the FBI, Secret

Service, U.S. Postal Inspection Service, Federal Trade Commission

(FTC), and several electronic crimes task forces around the country

to assist in identifying persons involved in phishing-type crimes.

Return to

the top of the newsletter

FFIEC IT SECURITY

-

We continue our coverage of the

FDIC's "Guidance on Managing Risks Associated With Wireless Networks

and Wireless Customer Access."

Part II. Risks Associated with Wireless Internet Devices

As wireless Internet devices become more prevalent in the

marketplace, financial institutions are adopting wireless

application technologies as a channel for reaching their customers.

Wireless Internet services are becoming available in major cities

across the United States. Through wireless banking applications, a

financial institution customer could access account information and

perform routine non-cash transactions without having to visit a

branch or ATM.

The wireless Internet devices available today present attractive

methods for offering and using financial services. Customers have

access to financial information from anywhere they can receive

wireless Internet access. Many of the wireless devices have built-in

encryption through industry-standard encryption methods. This

encryption has its limits based on the processing capabilities of

the device and the underlying network architecture.

A popular standard for offering wireless applications is through

the use of the Wireless Application Protocol (WAP). WAP is designed

to bring Internet application capabilities to some of the simplest

user interfaces. Unlike the Web browser that is available on most

personal computer workstations, the browser in a wireless device

(such as a cell phone) has a limited display that in many cases can

provide little, if any, graphical capabilities. The interface is

also limited in the amount of information that can be displayed

easily on the screen. Further, the user is limited by the keying

capabilities of the device and often must resort to many key presses

for simple words.

The limited processing capabilities of these devices restrict the

robustness of the encryption network transmissions. Effective

encryption is, by nature, processing-intensive and often requires

complex calculations. The time required to complete the encryption

calculations on a device with limited processing capabilities may

result in unreasonable delays for the device's user. Therefore,

simpler encryption algorithms and smaller keys may be used to speed

the process of obtaining access.

WAP is an evolving protocol. The most recent specification of WAP (WAP

2.0 - July 2001) offers the capability of encrypting network

conversations all the way from the WAP server (at the financial

institution) to the WAP client (the financial institution customer).

Unfortunately, WAP 2.0 has not yet been fully adopted by vendors

that provide the building blocks for WAP applications. Previous

versions of WAP provide encryption between the WAP client and a WAP

gateway (owned by the Wireless Provider). The WAP gateway then must

re-encrypt the information before it is sent across the Internet to

the financial institution. Therefore, sensitive information is

available at the wireless provider in an unencrypted form. This

limits the financial institution's ability to provide appropriate

security over customer information.

Return to the top of

the newsletter

NATIONAL INSTITUTE OF STANDARDS

AND TECHNOLOGY -

We

continue the series on the National Institute of Standards and

Technology (NIST) Handbook.

Chapter 20 -

ASSESSING AND MITIGATING THE RISKS TO A HYPOTHETICAL COMPUTER SYSTEM

(HGA)

20.4.1

General Use and Administration of HGA's Computer System

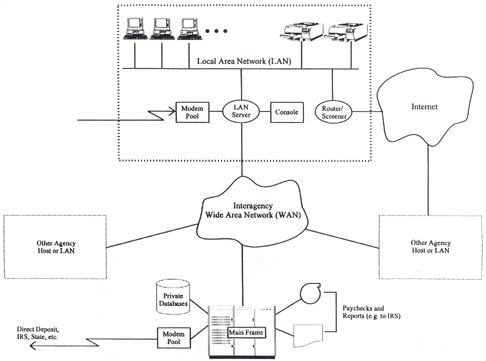

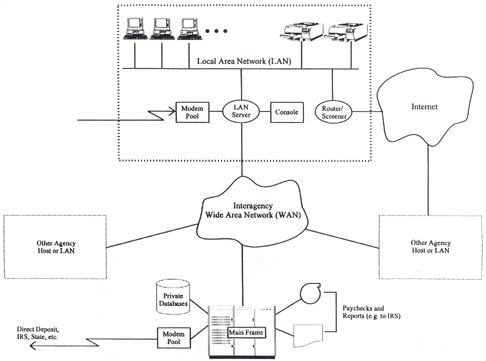

HGA's Computer

Operations Group (COG) is responsible for controlling,

administering, and maintaining the computer resources owned and

operated by HGA. These functions are depicted in Figure below

enclosed in the large, dashed rectangle. Only individuals holding

the job title System Administrator are authorized to establish

log-in ID's and passwords on multiuser HGA systems (e.g., the LAN

server). Only HGA's employees and contract personnel may use the

system, and only after receiving written authorization from the

department supervisor (or, in the case of contractors, the

contracting officer) to whom these individuals report.

COG issues copies of

all relevant security policies and procedures to new users. Before

activating a system account for new users, COG requires that they

(1) attend a security awareness and training course or complete an

interactive computer-aided-instruction training session and (2) sign

an acknowledgment form indicating that they understand their

security responsibilities.

Authorized users are

assigned a secret log-in ID and password, which they must not share

with anyone else. They are expected to comply with all of HGA's

password selection and security procedures (e.g., periodically

changing passwords). Users who fail to do so are subject to a range

of penalties.

Users creating data

that are sensitive with respect to disclosure or modification are

expected to make effective use of the automated access control

mechanisms available on HGA computers to reduce the risk of exposure

to unauthorized individuals. (Appropriate training and education are

in place to help users do this.) In general, access to

disclosure-sensitive information is to be granted only to

individuals whose jobs require it.

|