|

FYI

- Our cybersecurity testing meets

the independent pen-test requirements outlined in the FFIEC Information Security booklet. Independent pen-testing is part of any financial institution's cybersecurity defense.

To receive due diligence information, agreement and, cost saving fees,

please complete the information form at

https://yennik.com/forms-vista-info/external_vista_info_form.htm. All communication is kept strictly confidential.

FYI

- US court says NSA phone data program is illegal - The US

government has long argued that the program is legal under the

controversial Patriot Act, but a federal appeals court sees things

differently. A US Appeals court has sent shockwaves through the

government and security industry after ruling that the National

Security Agency's wholesale collection of phone call data is

illegal.

http://www.cnet.com/news/us-court-says-nsa-phone-data-program-is-illegal/

FYI

- India and Japan form cyber alliance - Indian officials from the

Ministry of Telecom and the Department of Electronics and

Information Technology (DeitY) met with a visiting Japanese trade

delegation led by Minister of Economy and Trade Yoichi Miyazawa

according to the Economic Times.

http://www.scmagazine.com/japan-looks-to-invest-in-indias-it-sectors/article/412811/

FYI

- House approves controversial cybersecurity bill - The House of

Representatives passed bipartisan legislation on Wednesday designed

to help companies and the federal government better defend against

the growing threat of cyberattacks, despite opposition from privacy

advocates.

http://www.cnet.com/news/house-approves-controversial-cybersecurity-bill/

FYI

- Romanian rozzers round up alleged $15 MILLION ATM cybercrim gang -

25 people arrested over international cash-slurp operation -

Romanian police have arrested 25 people who are suspected of being

part of a cyber-crime gang that organised $15m in fraudulent bank

withdrawals.

http://www.theregister.co.uk/2015/04/28/romanian_police_arrest_25_15m_swindle_allegations/

FYI

- Twin brothers indicted on computer hacking charges - Twin brothers

in Virginia were indicted Thursday on computer hacking and other

charges.

http://www.scmagazine.com/twin-brothers-indicted-on-computer-hacking-charges/article/412825/

FYI

- A former Goldman Sachs programmer has been convicted for the

second time in four years on charges that he misused his former

employer’s code, adding a new chapter to an already bizarre and

controversial case that has drawn much unwanted attention to the

world of high-speed trading and elicited criticism of prosecutorial

overzealousness.

http://www.wired.com/2015/05/programmer-convicted-bizarre-goldman-sachs-caseagain/

FYI

- Lower house of French Parliament approves surveillance bill - The

lower house of the French Parliament has approved a controversial

intelligence bill that could broaden the government's surveillance

powers.

http://www.scmagazine.com/french-surveillance-bill-progresses-through-parliament/article/413032/

ATTACKS, INTRUSIONS, DATA THEFT & LOSS

FYI

- Ryanair stung after $5m Shanghai'd from online fuel account -

Crooks siphoned off money from an account earmarked for the payment

of fuel bills via an electronic transfer to a bank in China last

week.

http://www.theregister.co.uk/2015/04/30/ryanair_online_heist/

FYI

- FBI investigating Rutgers University in DDoS attack - The FBI is

working with Rutgers University to identify the source of a series

of distributed denial-of-service (DDoS) attacks that have plagued

the school this week.

http://www.scmagazine.com/the-fbi-is-helpign-rutger-inveigate-a-series-of-ddos-attack/article/412149/

FYI

- Partners HealthCare says workers responded to phishing emails,

patient data at risk - Partners HealthCare Systems has published an

announcement on its website that personal and health-related data

belonging to its patients was potentially exposed to unauthorized

access.

http://www.scmagazine.com/partners-healthcare-group-patient-information-may-be-at-risk/article/412552/

FYI

- Oregon's Health CO-OP laptop stolen, about 15K members notified -

Oregon's Health CO-OP has notified approximately 15,000 current and

former members that a laptop containing personal information was

stolen.

http://www.scmagazine.com/oregons-health-co-op-laptop-stolen-about-15k-members-notified/article/412536/

FYI

- EllisLab server hacked, passwords possibly compromised - Hackers

last month gained unauthorized access to a server of software

development company EllisLab may have gotten their hands on personal

information belonging to EllisLab.com members, the company CEO Derek

Jones said in a Friday blog post.

http://www.scmagazine.com/attackers-use-stolen-login-info-to-hack-into-ellislabs-servers/article/412796/

FYI

- Possible payment card breach at Hard Rock Hotel & Casino Las Vegas

- Hard Rock Hotel & Casino Las Vegas is warning customers of a

potential security incident involving payment cards.

http://www.scmagazine.com/possible-payment-card-breach-at-hard-rock-hotel-casino-las-vegas/article/412819/

http://www.theregister.co.uk/2015/05/04/hard_rock_breach/

FYI

- Retail Capital notifies hundreds following security incident -

Michigan-based Retail Capital is notifying more than 700 individuals

that unauthorized access was gained to the electronic mailbox of a

sales manager, and personal information may have been compromised.

http://www.scmagazine.com/retail-capital-notifies-hundreds-following-security-incident/article/413042/

Return to the top

of the newsletter

WEB SITE COMPLIANCE -

OCC - Threats from

Fraudulent Bank Web Sites - Risk Mitigation and Response Guidance

for Web Site Spoofing Incidents (Part 3 of 5)

PROCEDURES TO ADDRESS SPOOFING - Information

Gathering

After a bank has determined that it is the target of a spoofing

incident, it should collect available information about the attack

to enable an appropriate response. The information that is

collected will help the bank identify and shut down the fraudulent

Web site, determine whether customer information has been obtained,

and assist law enforcement authorities with any investigation.

Below is a list of useful information that a bank can collect.

In some cases, banks will require the assistance of information

technology specialists or their service providers to obtain this

information.

* The means by which the bank became aware that it was the

target of a spoofing incident (e.g., report received through

Website, fax, telephone, etc.);

* Copies of any e-mails or documentation regarding other forms of

communication (e.g., telephone calls, faxes, etc.) that were used to

direct customers to the spoofed Web sites;

* Internet Protocol (IP) addresses for the spoofed Web sites

along with identification of the companies associated with the IP

addresses;

* Web-site addresses (universal resource locator) and the

registration of the associated domain names for the spoofed site;

and

* The geographic locations of the IP address (city, state,

and country).

Return to

the top of the newsletter

FFIEC IT SECURITY

-

We continue our coverage of

the FDIC's "Guidance

on Managing Risks Associated With Wireless Networks and Wireless

Customer Access."

PART I. Risks Associated with Wireless Internal Networks

Financial institutions are evaluating wireless networks as an

alternative to the traditional cable to the desktop network.

Currently, wireless networks can provide speeds of up to 11 Mbps

between the workstation and the wireless access device without the

need for cabling individual workstations. Wireless networks also

offer added mobility allowing users to travel through the facility

without losing their network connection. Wireless networks are also

being used to provide connectivity between geographically close

locations as an alternative to installing dedicated

telecommunication lines.

Wireless differs from traditional hard-wired networking in that it

provides connectivity to the network by broadcasting radio signals

through the airways. Wireless networks operate using a set of FCC

licensed frequencies to communicate between workstations and

wireless access points. By installing wireless access points, an

institution can expand its network to include workstations within

broadcast range of the network access point.

The most prevalent class of wireless networks currently available

is based on the IEEE 802.11b wireless standard. The standard is

supported by a variety of vendors for both network cards and

wireless network access points. The wireless transmissions can be

encrypted using "Wired Equivalent Privacy" (WEP) encryption. WEP is

intended to provide confidentiality and integrity of data and a

degree of access control over the network. By design, WEP encrypts

traffic between an access point and the client. However, this

encryption method has fundamental weaknesses that make it

vulnerable. WEP is vulnerable to the following types of decryption

attacks:

1) Decrypting information based on statistical analysis;

2) Injecting new traffic from unauthorized mobile stations

based on known plain text;

3) Decrypting traffic based on tricking the access point;

4) Dictionary-building attacks that, after analyzing about a

day's worth of traffic, allow real-time automated decryption of all

traffic (a dictionary-building attack creates a translation table

that can be used to convert encrypted information into plain text

without executing the decryption routine); and

5) Attacks based on documented weaknesses in the RC4

encryption algorithm that allow an attacker to rapidly determine the

encryption key used to encrypt the user's session).

Return to the top of

the newsletter

NATIONAL INSTITUTE OF STANDARDS

AND TECHNOLOGY -

We

continue the series on the National Institute of Standards and

Technology (NIST) Handbook.

Chapter 20 -

ASSESSING AND MITIGATING THE RISKS TO A HYPOTHETICAL COMPUTER SYSTEM

(HGA)

20.3.5 Network-Related

Threats

Most of the human

threats of concern to HGA originate from insiders. Nevertheless, HGA

also recognizes the need to protect its assets from outsiders. Such

attacks may serve many different purposes and pose a broad spectrum

of risks, including unauthorized disclosure or modification of

information, unauthorized use of services and assets, or

unauthorized denial of services.

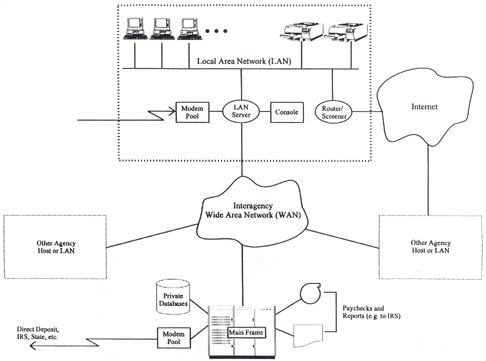

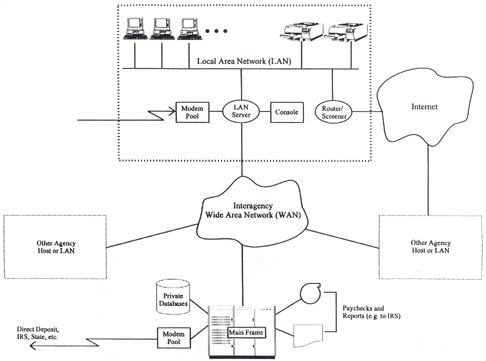

As shown in the figure

below, HGA's systems are connected to the three external networks:

(1) the Internet, (2) the Interagency WAN, and (3) the

public-switched (telephone) network. Although these networks are a

source of security risks, connectivity with them is essential to

HGA's mission and to the productivity of its employees; connectivity

cannot be terminated simply because of security risks.

In each of the past few

years before establishing its current set of network safeguards, HGA

had detected several attempts by outsiders to penetrate its systems.

Most, but not all of these, have come from the Internet, and those

that succeeded did so by learning or guessing user account

passwords. In two cases, the attacker deleted or corrupted

significant amounts of data, most of which were later restored from

backup files. In most cases, HGA could detect no ill effects of the

attack, but concluded that the attacker may have browsed through

some files. HGA also conceded that its systems did not have audit

logging capabilities sufficient to track an attacker's activities.

Hence, for most of these attacks, HGA could not accurately gauge the

extent of penetration.

In one case, an

attacker made use of a bug in an e-mail utility and succeeded in

acquiring System Administrator privileges on the server--a

significant breach. HGA found no evidence that the attacker

attempted to exploit these privileges before being discovered two

days later. When the attack was detected, COG immediately contacted

the HGA's Incident Handling Team, and was told that a bug fix had

been distributed by the server vendor several months earlier. To its

embarrassment, COG discovered that it had already received the fix,

which it then promptly installed. It now believes that no subsequent

attacks of the same nature have succeeded.

Although HGA has no

evidence that it has been significantly harmed to date by attacks

via external networks, it believes that these attacks have great

potential to inflict damage. HGA's management considers itself lucky

that such attacks have not harmed HGA's reputation and the

confidence of the citizens its serves. It also believes the

likelihood of such attacks via external networks will increase in

the future.

|